How to Become a Public Adjuster in Illinois? Complete 2025 Guide

Aug 29, 2025

You can become a public adjuster in Illinois by acquiring a license. The prerequisite for this is passing the Illinois PA exam, paying the necessary fees, and filling out forms with the NIPR and Pearson VUE.

The process often leaves novices confused, which is why we've explained everything in a step-by-step manner. We've even got the secret trick to help you get your license faster than everyone else.

Guide to Becoming an Illinois Public Adjuster

Becoming a public adjuster in Illinois requires extensive study and direction. Many people don't even know what they need to do to get started. Here's the complete guide to help you become a licensed insurance adjuster in Illinois:

1. Apply for a Public Adjuster License Exam

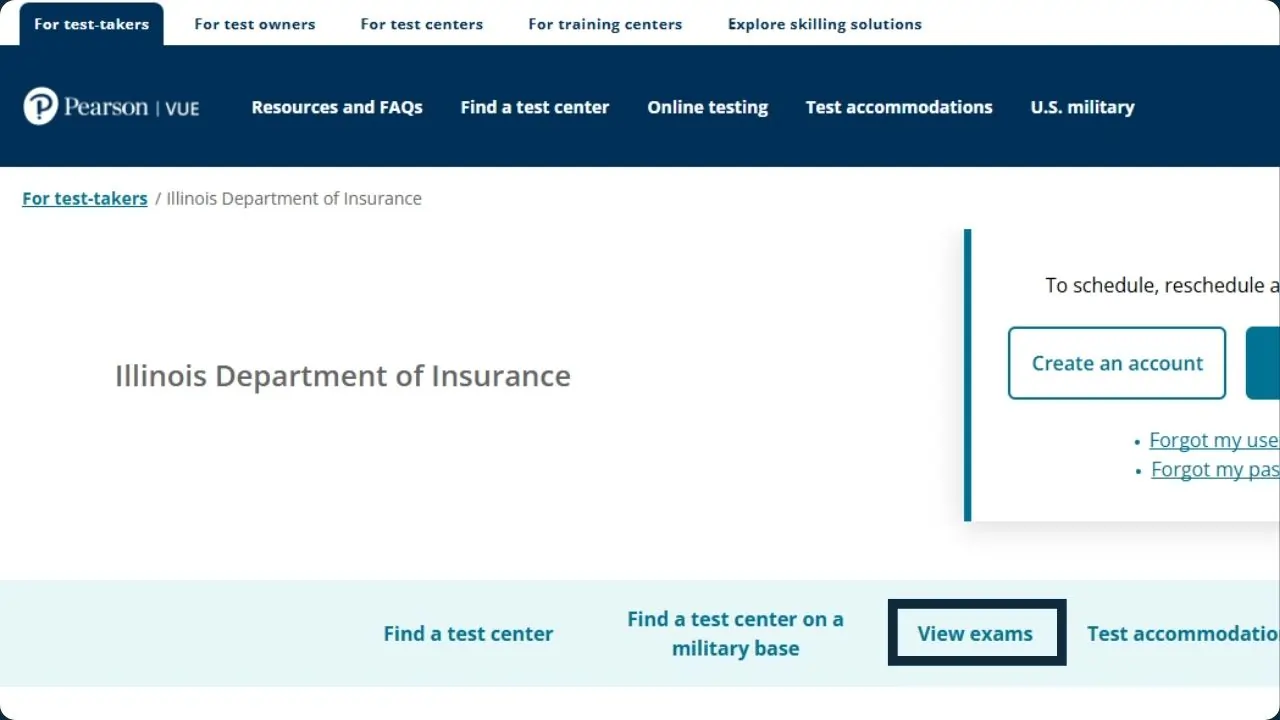

The first step is to apply for a public adjuster license exam with Pearson VUE. For reference, Pearson VUE is an IT Service company that manages various qualification exams on behalf of various departments.

The Department of Insurance also employs Pearson VUE to manage the Illinois public adjuster exam. You will have to visit the Pearson Vue website to sign up for the exam. Here's how you do it:

- Visit the Pearson VUE Department of Insurance page.

- Click on the View Exam button.

- Type "Public Adjuster" in the box and click Go.

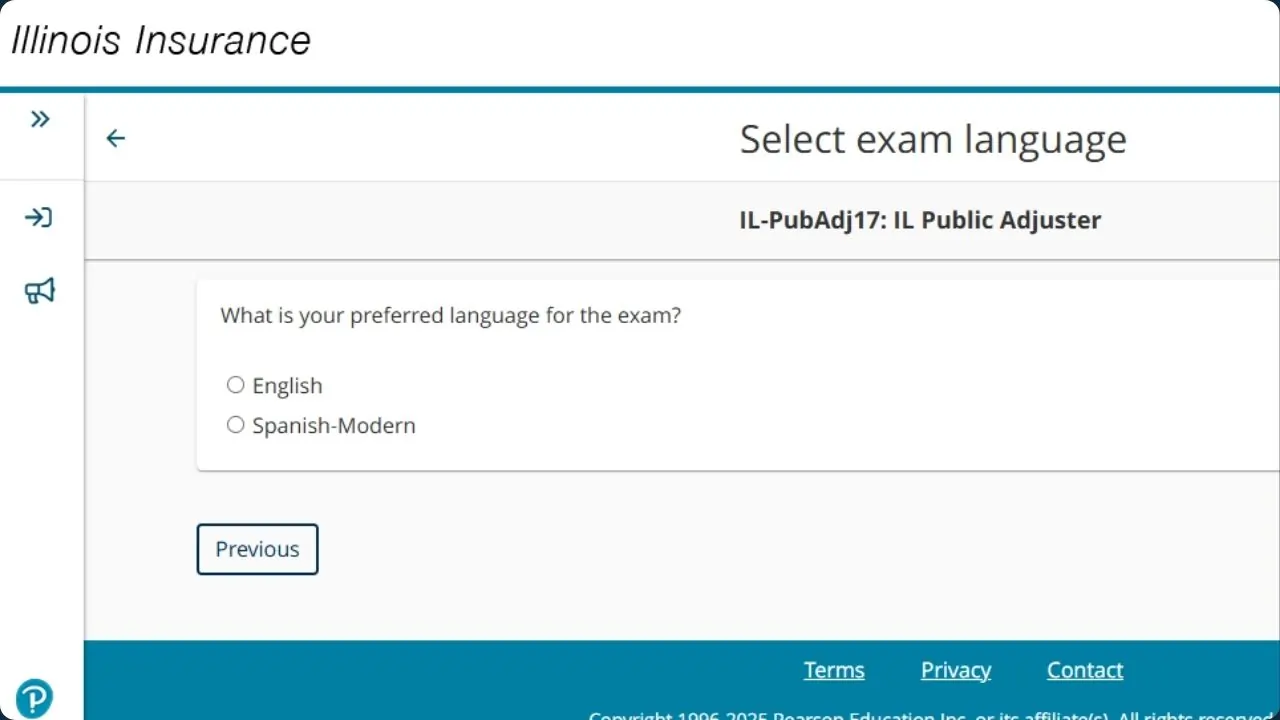

- Choose your preferred language and click on Next.

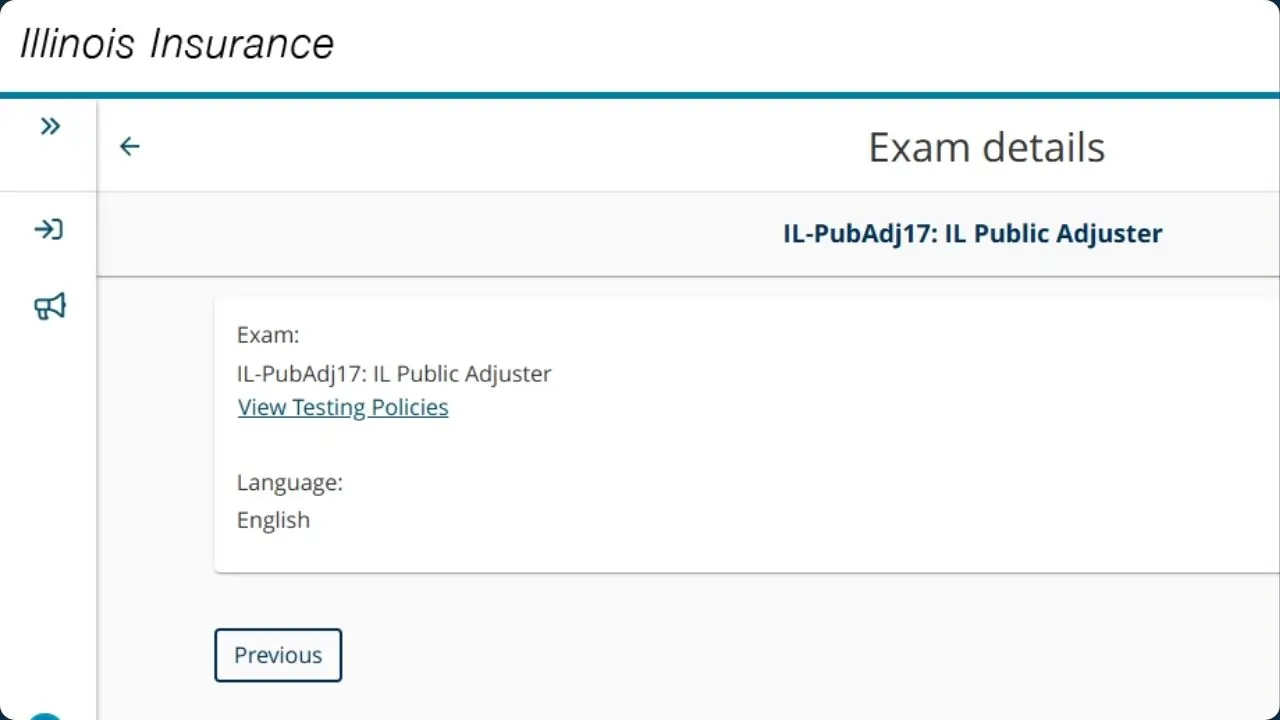

- Read the Testing Policies and click on Next.

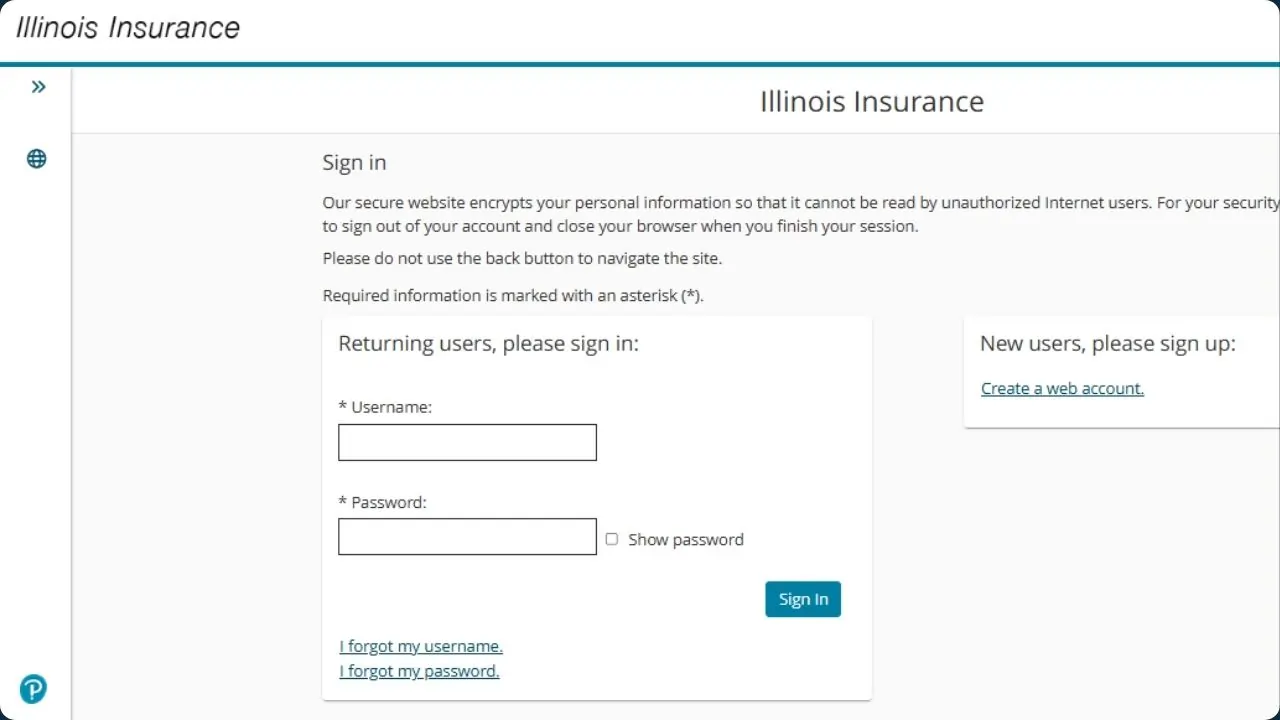

- Click on Create a New Account.

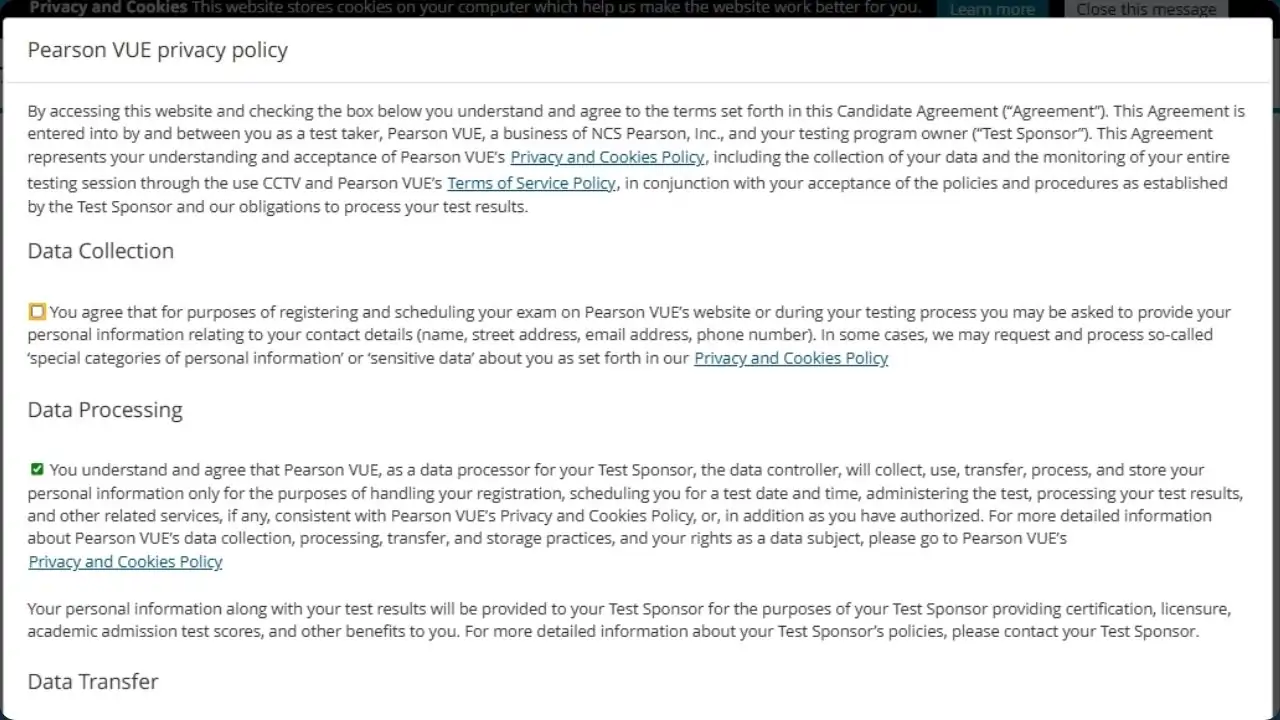

- Agree to the Data Privacy Policy.

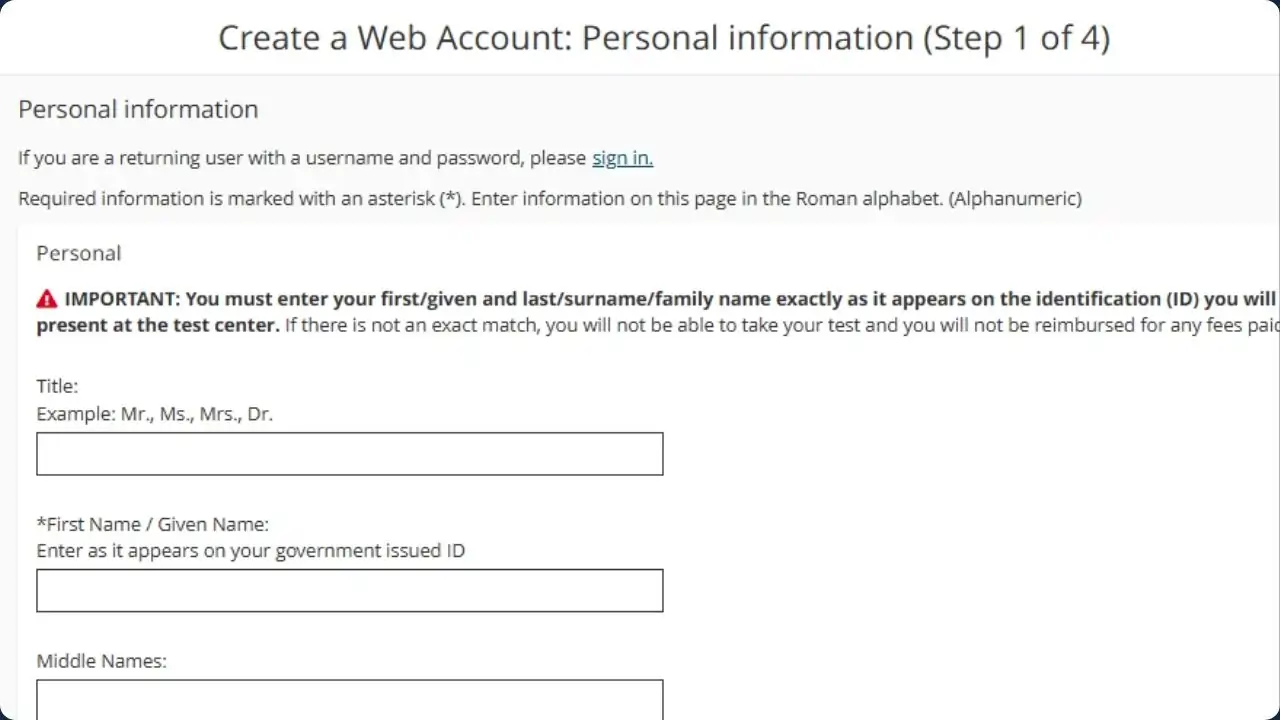

- Enter your details (Name, Birthday, Email, SSN).

- Finish the account creation process.

- Pay the $92 examination fee through electronic transfer.

After you've confirmed everything, you'll receive an email. Please remember, public adjuster exams are arranged on demand. You can choose an exam date according to your schedule.

2. Study and Prepare for the Exam

The public adjuster exam isn't easy, especially for novices. You'll need information about various concepts, including:

- Homeowner’s Policy, Standard Fire Policy

- Ho-1 - Ho-8, Proof-of-Loss Forms

- Cancellation/Non-Renewal Provisions

- Pair and Set Clause, Subrogation

- RPL/ACV, B.O.P.

- Commercial Property Causes of Loss Forms

- Coinsurance, Deductibles

- Commercial Package Policy

- Inland Marine, Floaters, Inland Marine Policy

- Occurrence/Claims Made

- Policies, Bond Principles, and Types

- Commercial Crime, Time Element Coverage

- Boiler and Machinery Insurance

- FEMA-Flood Insurance

- Crime Insurance, Leasehold Interest

- Legal Liability, Named Insured

- Insurable Interest, Ordinance of Law

- Stated/Agreed Values, Non-Waiver

- Agreement, Fidelity Bond

- Valuable Papers and Records

You can get a brief understanding of these terms and correlations from the IRMI website. Unfortunately, understanding the definitions of these terms isn't enough to get an Illinois Public Adjuster License.

You'll need to study all these aspects and understand their connections with Illinois Law. If you want to pass your exam on the first try, join our public adjuster exam classes. We explain everything from insurance claims and communication.

3. Pass the Public Adjuster Exam

The examination day will arrive sooner than you expect. Rest well before the exam and prepare the necessary materials. According to Pearson VUE, you will need the following items on exam day:

- One Primary ID: Government-issued ID with name, image, and signature

- One Secondary ID: With a recently matching name, signature, and image

You might be denied attendance if you fail to provide original copies of these IDs. You might also be required for palm vein and fingerprint live scans. Please read the full ID policy from Pearson VUE to understand what you'll need.

4. Collect Pre-Licensing Requirements

Passing the exam isn't the only thing you need to get your Illinois public adjuster license. You need to meet some basic requirements, which include:

- Being at least 18 years old

- Submit a fingerprint background check

- Secure a $50,000 Illinois public adjuster surety bond

- Proof that you have passed the exam from Pearson VUE

Apart from this, you need to meet all the statutes of the Illinois Insurance Code and Administrative Rule 3118.

5. Get Your PA License

The examination is a qualifying procedure. It doesn't automatically give you a license. Apply for your license with the Illinois Department of Insurance after you pass your exam. Visit the National Insurance Producer Registry (NIPR) and apply for a new license.

While you're applying, you will have to attach the following documents:

- Evidence of financial responsibility in the amount $50,000 in the form of a surety bond or certification of an irrevocable letter of credit.

- The Public Adjuster contract as per Section 1501 of the Illinois Insurance Code and Administrative Rule 3118.

Fill out the necessary form and attach your proof of qualification. Failure to provide these will lead to a rejection, which means you will have to repay the $250 application fee.

When you're done with the application, wait for confirmation. You will receive your license within a few weeks.

Is Becoming a Public Adjuster Hard?

Becoming a public adjuster is surprisingly hard because of the required skills, exam, and application process. The last part is perhaps the hardest aspect because of the contrived process.

You have to apply for an exam with Pearson VUE, pass the exam, and then apply for a license with the NIPR. These three steps sound easy on paper, but each one requires certain financial and mental preparation.

We know it can get confusing, but the career is worth it. Public adjusters earn more than most service industry professionals. This career is rewarding mentally, financially, and physically.

FAQs on Becoming an Insurance Adjuster

How much do public adjusters make in Illinois?

Public adjusters make around $67,000 on average in Illinois. When calculating based on hours, a public adjuster earns an average hourly wage of $30. The income of a public adjuster is tied deeply to the type of work, frequency, and experience level.

How much does a public adjuster license cost?

Public adjuster licenses cost around $350, which includes a $92 examination fee and $250 application fee. You must pay the examination fee to Pearson VUE before getting your license. You'll pay the application fee to the NIPR and IDoI after you've passed the exam.

What disqualifies you from getting an insurance license in Illinois?

You can be disqualified from getting an insurance license in Illinois if you have committed a felony or submitted false information on your application. You can find all these metrics in Section 2403.30 under Director of Insurance, Hearings and Review..

Bottom Line on Getting a Public Adjuster License

You can only become a public adjuster after you meet the requirements, pass the exam, acquire the surety bond, and pass a background check. While doing this, you will have to pay a non-refundable examination and application fee.

Becoming a licensed public adjuster is much easier with the right help. At Illinois Roofing Institute, we prepare you for the exam, the forms, and everything that comes after. We'll help you fill out every form from examination to licensing.

If you're ready to become a successful public adjuster, join our PA exam prep classes. Your career is a few clicks away!